eToro India Review

Bonus

Etoro does not offer any bonuses

- Organization eToro (Europe) Ltd.

- Payout option 71%

- Minimum Deposit $10

- Demo account Yes, Unlimited

- Indian Yes

- Compatibility Android, Mac OS, Windows, iOS

- Platform type Self - Developed

- Minimum investment value $1

Contents

eToro is a veteran Forex broker founded in 2007 in Israel. It is among the pioneers of social trading. Since its establishment, eToro has attracted over 10 million customers in over 140 countries.

eToro’s brokering services are offered by eToro Ltd, a Cypriot Investment Firm.

Various authorities regulate this broker, including the popular Cyprus Securities & Exchange Commission (CySEC) and Financial Conduct Authority (FCA).

It also has another by Australian Securities and Investments Commission (ASIC). India is among the countries where this eToro is legal. The company has refined its offers and continues adding more products; Indian customers are assured of the ultimate trading experience.

eToro is a winner for its user-friendly trading platform. The site simplifies data exchange between traders by speeding up the sharing of experiences. This reduces the learning period for those who wish to grow their trading techniques to higher levels.

Traders can easily duplicate investors’ trades across over 2000 instruments, including Forex, CFDs, and popular Cryptocurrencies. If you are new to trading, you can start with the demo account to learn the basics before opening a real account.

In this review, we will dig deeper into the key offerings of this broker, including assets, commissions, spreads, and more. Let us find out what this broker has in store for Indian traders.

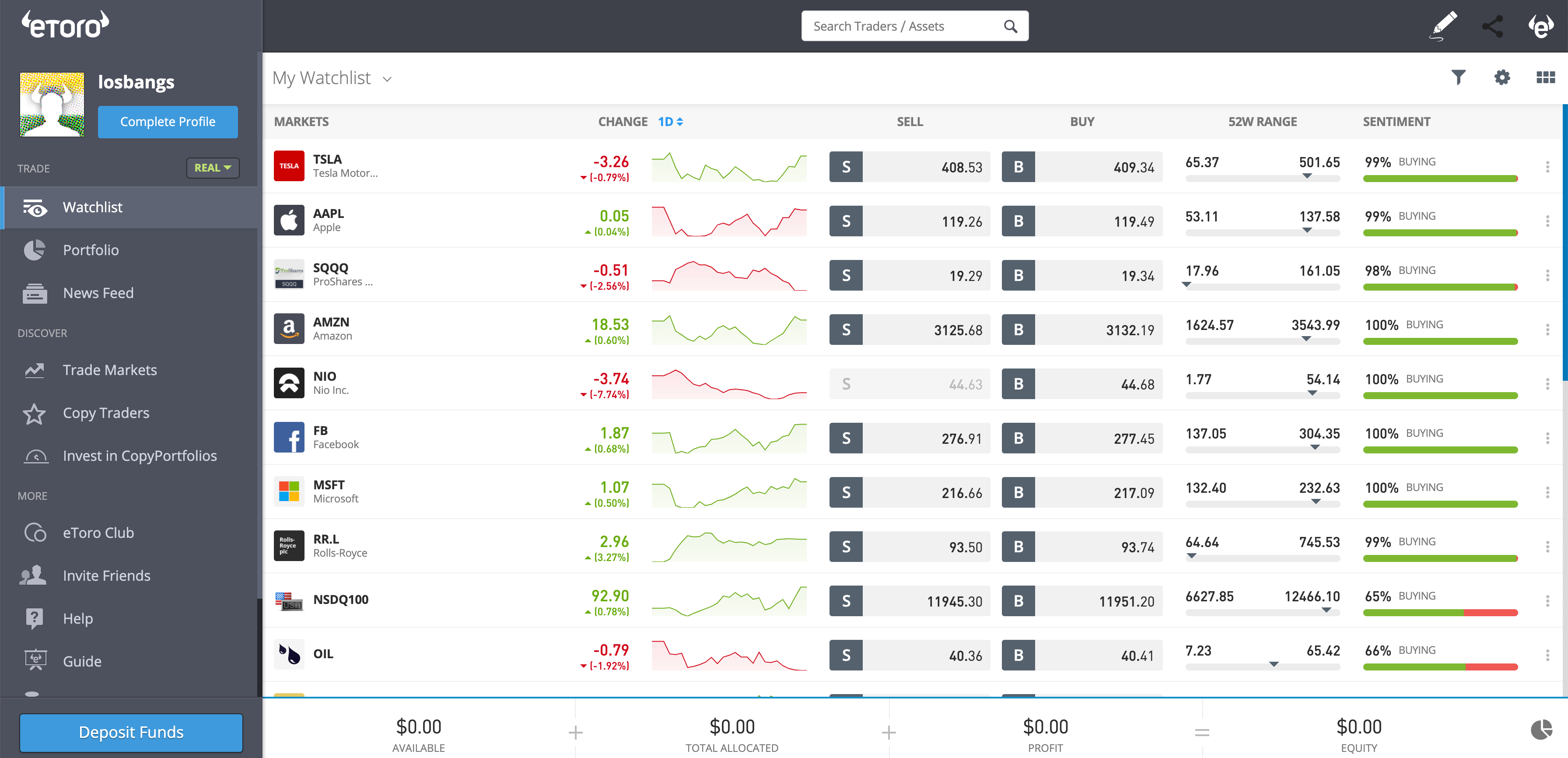

Visit EtoroTrading Offers (Assets)

There is a wide range of underlying assets at eToro. Indian traders can choose from over 2000 assets, including more than 1750 Stocks, 150 ETFs, 16 Cryptocurrencies, 31 commodities, 13 indices, and 49 currency pairs.

Each class of assets has its characteristics, and you can use different strategies to trade.

Generally, the trading suite entails two key categories, investment assets and tradable assets. Investment means retaining ownership of the asset until you decide to cash out.

Here, you can invest in ETF, Stock, or Cryptocurrency. You can also benefit from fractional ownership, where you are not required to purchase the asset fully. You can buy as little as you wish as long as you meet the minimum investment, INR1800 for Cryptocurrencies and INR3600 for stocks and ETFs.

For tradable assets, eToro provides fully-fledged trading facilities. It means you can trade on the short-term price movement of an asset or keep the position on hold for minutes, days, or weeks but rarely for a few months.

Therefore, you will be taking small margins on your trades frequently.

Here, you are more likely to trade on CFDs meaning you will not own the underlying asset. You can trade on CFD instruments like Stocks, ETFs, Cryptocurrency, Currencies, and Commodities.

Whenever you are trading CFDs, you assess the short-selling facilities. In simple terms, when placing a buy order, you are speculating the asset’s value will rise quickly.

Visit EtoroTrading Account Types

There are four main trading accounts at eToro, a demo account, a standard account, a VIP account, and an Islamic account. Opening as a standard account is easy, as it only requires a minimum deposit of INR14600.

The VIP account requires a higher investment of INR367200 and above. eToro also offers an Islamic account where traders do not incur swap fees, per Islamic laws.

The minimum deposit for the Islamic account is INR73400. Each account allows users to engage in Toro’s weekly competitions. The VIP account has more benefits, like monthly analysis, account manager, and other returns.

If you wish to learn how eToro works or are new to trading, you can open a demo account. Once you open a demo account, you receive INR734500 practice cash to execute your trial trades.

You can apply for more cash if you run out of money. Once you have made significant profits and are confident with your skills, you can proceed to a live account.

Visit EtoroCommissions and Spreads

When trading online, you must grasp what commissions or fees you must pay. Spreads are also significant when deciding on your trade. Here is what Indian traders should expect to find at eToro.

Commissions

The eToro’s headline offering is that you can trade and invest without paying any commission. The broker allows you to trade on Stocks, ETFs, and Cryptocurrencies without any dealing fees or commissions.

It is among the leading pricing structures in the industry, which is arguable, why eToro has over 10 million investors.

Overnight Financing

When purchasing Stocks, Cryptocurrencies, and ETFs, you own the respective asset. That means you can hold the asset for as long as you want without paying any fees. Nonetheless, this is not the case for CFDs.

CFDs are leveraged financial products, meaning you must pay a small daily fee through overnight financing.

It is charged each day when you hold your position after closing of the markets. For positions held over the weekend, some but not all CFD assets incur an enhanced charge. Overnight financing fees vary with the market and assets.

Hence, you can easily view your exact fees when loading an order. The total amount is displayed as ‘per-day’ charges.

Spreads

Spread is the difference between buying and selling prices. The eToro spreads change depending on the trading time, liquidity, or volatility. The more volatile the market is, the wider the spreads.

Generally, the trading platforms get highly competitive during standard market hours.

Deposit and Withdrawals Options

Indian traders can access several payment methods at eToro. The site accepts payments through 9 currencies, including EUR, AUD, GBP, RMB, IDR, THB, VND, MYR, and PHP. Indians can use IDR or any other currency of their choice. Let us look at the available deposit and methods.

Deposits

eToro makes depositing funds into your account a breeze. The available deposit methods include Debit, Credit Cards, Skrill, Revolut, Paypal, Neteller, Giropay, and Bank transfers. All deposits are instant except those done through Bank Transfer, which may take up to 5 working days.

Regarding deposit fees, eToro does not have a fixed fee per se. However, you will incur a 0.5% conversion fee when depositing in pounds. The minimum first-time deposit is INR14600, while from the second onwards is INR3600.

To deposit funds to your account, log in to the personal client area. The “Deposit Money” menu button lets you specify your preferred currency, amount, and payment method.

Withdrawals

The above deposit methods can also be used for withdrawals. All payouts incur a INR360 fee, and the minimum withdrawal amount is INR2200. Withdrawals take up to 24 hours or less except for Bank Transfers, which may take up to 5 working days.

As long as your withdrawal request is under review, you can cancel if you wish to by hitting the “ Reverse” button on your portfolio. There is no limit on the maximum amount of cash you should withdraw at eToro.

Trading Platforms

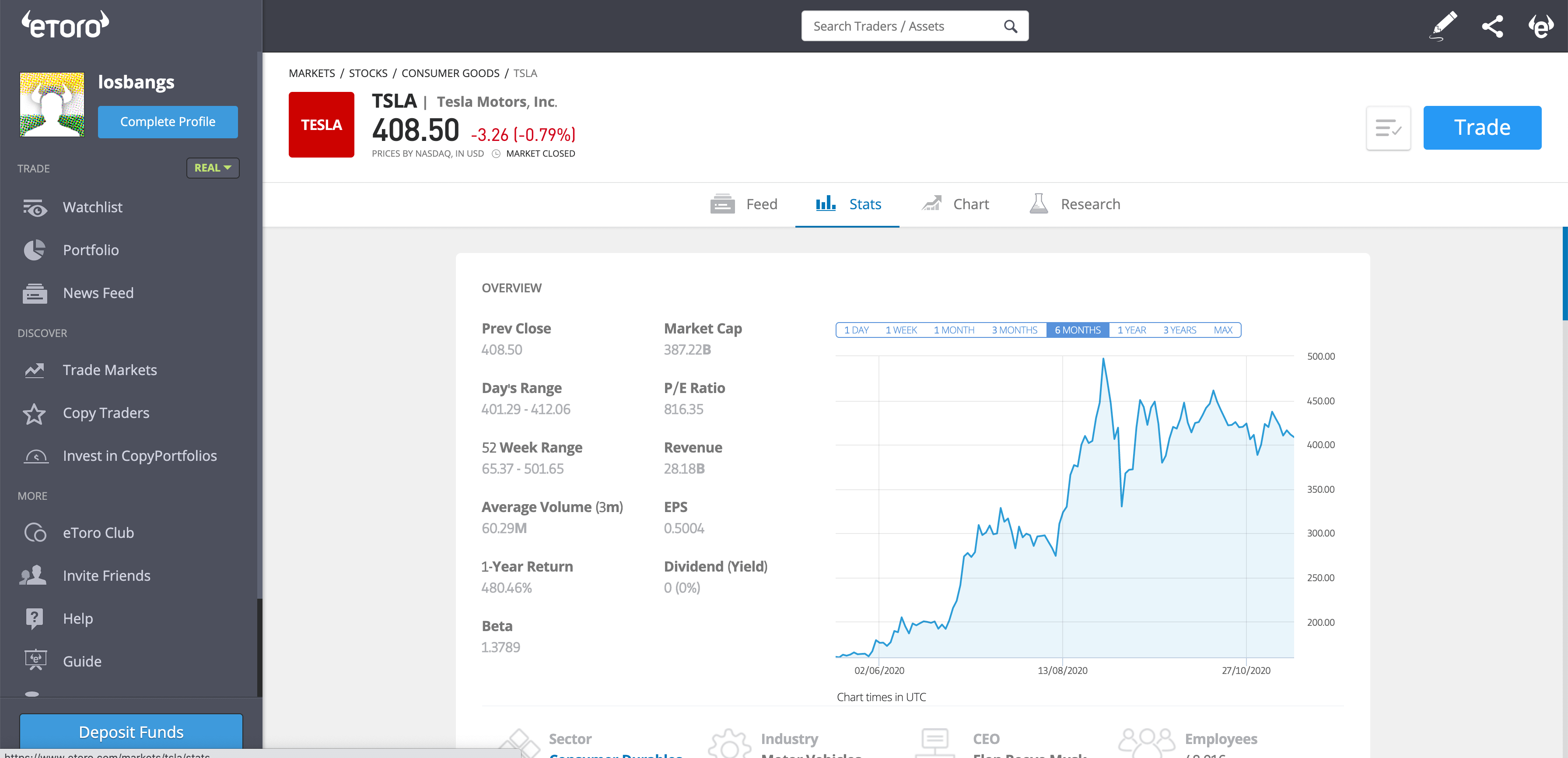

Unlike most brokers, eToro offers a proprietary web-trader platform. This trading platform fully supports Copy Portfolios and Copy trader’s social trading opportunities, which are eToro’s primary focus.

It is easy to use and is enhanced with TipRanks, offering traders insights from more than 15000 analysts.

There are pro charts for enabling manual traders to conduct technical analysis. The basic features resemble those of other platforms. You will notice that eToro’s proprietary platform has a cleaner and more intuitive interface than MT4/5.

The only downside of this platform is that it does not have auto trading systems. However, social trading can offer an alternative to auto trading. Each of these trading styles has its pros and cons, and they are not interchangeable.

The eToro trading platform is impressive, user-friendly, and intuitive. Both seasoned and novice traders will get along.

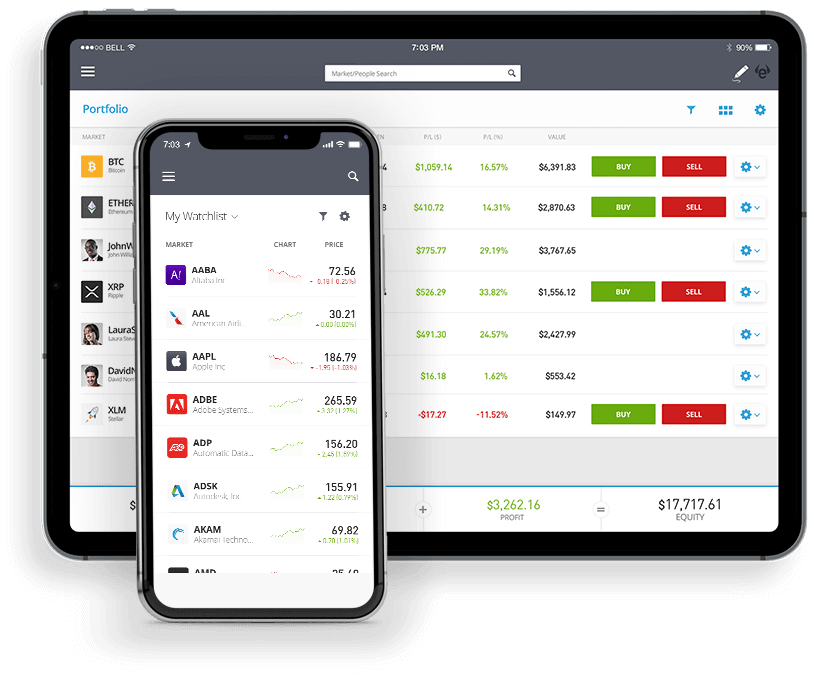

Mobile Trading

With the rapid growth in the mobile trading market, most users prefer trading on the go. eToro offers a downloadable mobile app with all features, services, and products available in the desktop version.

The app can be used on Android and iOS devices and is responsively available in the Google Play and Apple Store.

It has a simple design that is easy to navigate. You can easily access essential features such as trading instruments, payments, and customer support.

If you do not wish to download the app, you can use the web-based version to log in to your account through the browser.

Bonuses and Promotions

eToro allows you to enjoy up to INR 3670 through the refer-a-friend offer. You will be given a referral link to share with as many friends as you wish. To receive the offers, your friend must create an account and place a minimum trade of INR7300.

In addition, your friend receives INR 3670 by joining through the referral link as a welcome bonus.

Visit EtoroCustomer Support

eToro customer service is impressive, with highly skilled and friendly agents. They are available 24/5 to respond to all traders’ questions and concerns. You can reach them through live chat, phone call, or email. Live chat is the fastest way of receiving instant responses.

It is ideal for urgent matters. If you want to talk directly to someone, you can call at +44-866-350-0881, and one representative will attend to you.

In case you do not have an urgent matter, you can send an email to [email protected]. Due to high traffic, it might take up to 48 hours to receive your response.

This broker also features a comprehensive FAQ section that answers common questions about registration, payments, promotions, and more. You can go through it before you contact the support team.

If you do not find answers to your queries, feel free to ask for help. eToro is a multi-lingual platform, and your preferred language is at the top right of your screen.

FAQ

-

Is eToro regulated?Yes. eToro is regulated by various authorities including the popular Cyprus Securities & Exchange Commission (CySEC), and Financial Conduct Authority (FCA). It also has another by Australian Securities and Investments Commission (ASIC). To receive these licenses, a broker must adhere to all laws of the online trading industry.

-

How does eToro make money?eToro makes money through financing costs and spreads on over 2000 assets. These are the main revenues stream for eToro. They also charge a withdrawal fee of a INR360 per transaction.

-

Is eToro suitable for day trading?Yes. eToro offers CFDs trading that enables you to open and close your market position at any time. It is, therefore, suitable for day trading.

-

What can I trade on?You can trade on more than 2000 assets. They are divided into different classes, including more than 1750 Stocks, 150 ETFs, 16 Cryptocurrencies, 31 commodities, 13 indices, and 49 currency pairs. You may decide to invest in long term positions or trade on CFDs.

-

What do I need to open a live account?Opening a live account is easy, as it requires little investment. A standard account requires a minimum deposit of INR14600. If you want to be a higher roller, you can open a VIP account that requires a minimum deposit of INR367200. A VIP account has exclusive benefits, including monthly analysis, account manager, and additional returns.

-

Does eToro offer a Meta Trader 4 platform?Unfortunately, eToro does not offer a Meta Trader 4 trading platform. However, its proprietary platform is impressive and easy to use. You should give it a trial.

Conclusion

eToro has established itself as a leading broker in social trading. It is a home for more than 10 million traders. The broker offers more than 2000 trading assets across six classes. Their proprietary platform is impressive with an intuitive design.

Both new and seasoned traders will find their way into the platform. If you love playing on the move, eToro got you covered.

eToro prioritizes offering traders the best environment; as such, the customer support representatives are available 24/5 to ensure everything runs smoothly.

The only downside of this broker is that it does not offer a Meta Trader 4 trading platform like most leading brokers in the industry. However, this should not despair you from experiencing the incredible features and services offered by eToro.

- Helpful Guide on How to Use Parimatch in India - September 6, 2023

- What is Matched Betting and What are its Advantages? An Ultimate Guide - July 19, 2023

- Top IPL Betting Apps - November 4, 2022